Relevant for Exams

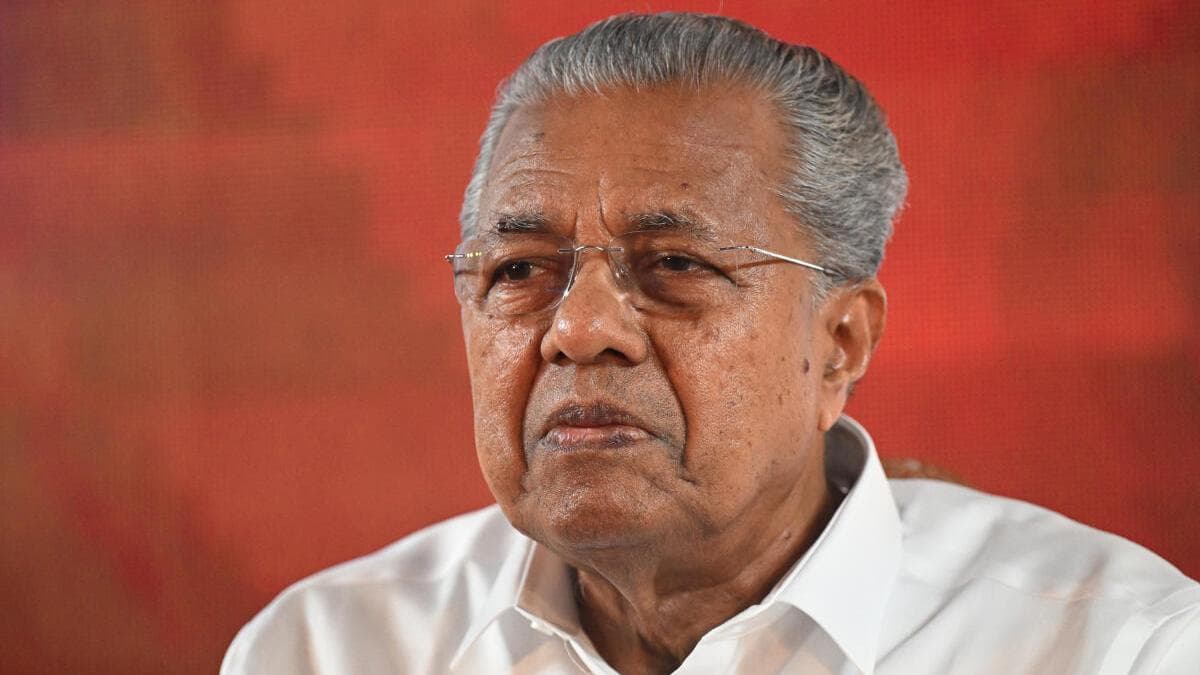

Kerala HC stays ED's show-cause notice to CM Pinarayi Vijayan and others in KIIFB masala bonds case.

Summary

The Kerala High Court has stayed proceedings on a show-cause notice issued by the Enforcement Directorate (ED) to Kerala CM Pinarayi Vijayan, former Finance Minister Thomas Isaac, and KIIFB CEO K.M. Abraham. This action relates to the Kerala Infrastructure Investment Fund Board (KIIFB) masala bonds issue. The stay order is significant for understanding the interplay between central investigative agencies and state financial bodies, and the legal challenges faced by state officials regarding financial instruments, making it relevant for exams on federalism and economic governance.

Key Points

- 1The Kerala High Court issued a stay order on proceedings against a show-cause notice.

- 2The show-cause notice was issued by the Enforcement Directorate (ED).

- 3The notice was served to Kerala CM Pinarayi Vijayan, former Finance Minister Thomas Isaac, and KIIFB CEO K.M. Abraham.

- 4The issue pertains to the Kerala Infrastructure Investment Fund Board (KIIFB) masala bonds.

- 5The stay order came on a joint petition filed by Vijayan, Isaac, and Abraham challenging the ED's notice.

In-Depth Analysis

The Kerala High Court's recent stay on proceedings related to an Enforcement Directorate (ED) show-cause notice concerning the Kerala Infrastructure Investment Fund Board (KIIFB) masala bonds issue is a significant development, offering a crucial lens into India's federal structure, economic governance, and the interplay between central investigative agencies and state financial autonomy.

**Background Context: KIIFB and Masala Bonds**

The Kerala Infrastructure Investment Fund Board (KIIFB) was established in 1999 by the Government of Kerala, later significantly revamped in 2016 through the KIIFB Act, 1999 (Amendment Act, 2016). Its primary objective is to mobilize funds for critical infrastructure projects and development initiatives across the state, bypassing the traditional budgetary constraints. To achieve this, KIIFB was authorized to raise funds from both domestic and international markets. One such innovative financial instrument it utilized was the 'masala bond'. Masala bonds are rupee-denominated bonds issued outside India by Indian entities. They aim to tap into international capital markets while shielding the issuer from currency fluctuation risks, as the bonds are denominated in Indian rupees. KIIFB successfully issued its inaugural masala bonds worth ₹2,150 crore (approximately $312 million) in 2019 on the London Stock Exchange, becoming the first sub-sovereign entity in India to do so. This move was celebrated as a novel approach to state-level infrastructure financing.

**What Happened: ED's Notice and High Court's Stay**

The controversy began when the Enforcement Directorate (ED), a central agency tasked with enforcing economic laws and combating economic crime, initiated an investigation into the KIIFB's masala bond issuance. The ED's contention was that the issuance potentially violated provisions of the Foreign Exchange Management Act (FEMA), 1999. It alleged that the KIIFB's borrowing through masala bonds did not conform to the guidelines set by the Reserve Bank of India (RBI) for External Commercial Borrowings (ECBs), particularly regarding the end-use of funds and the nature of the borrowing entity. Consequently, the ED issued a show-cause notice to key figures involved in the KIIFB's operations: Kerala Chief Minister Pinarayi Vijayan, who is also the Chairman of KIIFB; former Finance Minister Thomas Isaac, who was instrumental in the bond issuance; and KIIFB CEO K.M. Abraham. These officials, challenging the ED's jurisdiction and the legality of its notice, filed a joint petition before the Kerala High Court. The High Court, after hearing the petitioners' arguments, issued a stay order on the proceedings initiated by the ED's show-cause notice. This temporarily halts the ED's action and provides relief to the state officials.

**Key Stakeholders Involved**

1. **Kerala Infrastructure Investment Fund Board (KIIFB)**: The state-owned entity at the heart of the issue, responsible for infrastructure financing.

2. **Government of Kerala (CM Pinarayi Vijayan, former FM Thomas Isaac, KIIFB CEO K.M. Abraham)**: The state executive and its officials, asserting their right to raise funds for state development and challenging central oversight.

3. **Enforcement Directorate (ED)**: The central investigative agency, exercising its powers under FEMA, 1999, to scrutinize foreign exchange transactions.

4. **Reserve Bank of India (RBI)**: The central bank and primary regulator for foreign exchange transactions and external commercial borrowings, whose guidelines are central to the ED's allegations.

5. **Kerala High Court**: The judicial body providing the interim relief by staying the ED's proceedings, acting as an arbiter in the dispute.

**Significance for India**

This case holds profound significance for several aspects of Indian governance and economy:

* **Federalism and Centre-State Relations**: It highlights the ongoing tension between the Union government and state governments, particularly when central agencies investigate state-level financial decisions. Critics often argue that such investigations by central agencies like the ED, CBI, or NIA are politically motivated, infringing upon the fiscal autonomy and administrative space of states. This dispute underscores the delicate balance of power enshrined in the Indian Constitution.

* **Fiscal Autonomy of States**: The ability of states to raise funds independently for development projects is crucial for their economic growth. KIIFB's masala bond issuance represented an innovative approach to bypass reliance on central grants or traditional domestic borrowing limits (Article 293 of the Constitution governs state borrowing). The ED's action questions the extent of this autonomy and the regulatory oversight involved.

* **Economic Governance and Financial Innovation**: The case brings into focus the regulatory framework for novel financial instruments like masala bonds and the interpretation of FEMA guidelines. It will likely lead to clearer definitions of 'state entities' and their compliance requirements for international borrowing, impacting future financial innovations by other states.

* **Rule of Law and Judicial Review**: The High Court's intervention reaffirms the judiciary's role in reviewing executive actions and ensuring due process. It provides a legal check on the powers of central investigative agencies.

**Historical Context and Constitutional Provisions**

Disputes over centre-state financial relations are not new in India's federal history. Article 293 of the Indian Constitution empowers states to borrow within India upon the security of their consolidated fund, but borrowing outside India requires the consent of the Government of India if any part of a previous loan from the Centre is outstanding. The KIIFB case, however, involves a bond issued by a state-backed entity rather than the state government directly, raising questions about whether it falls under the direct purview of Article 293 or if it's a financial instrument subject to general foreign exchange regulations. The ED's jurisdiction primarily stems from the Foreign Exchange Management Act (FEMA), 1999, which replaced the more stringent Foreign Exchange Regulation Act (FERA), 1973. FEMA aims to facilitate external trade and payments and promote the orderly development and maintenance of the foreign exchange market in India. The RBI, under the RBI Act, 1934, frames regulations for external commercial borrowings, which KIIFB's masala bonds are subject to.

**Future Implications**

The outcome of this case will have far-reaching implications. A definitive judicial pronouncement could clarify the regulatory boundaries for state-backed entities issuing international bonds, potentially either encouraging or deterring similar initiatives by other states. It will also set a precedent regarding the extent to which central agencies can investigate state financial bodies and the grounds for such investigations. Politically, it might intensify the ongoing debate on federalism and the alleged weaponization of central agencies. Economically, it could influence investor confidence in state-backed financial instruments if regulatory clarity is not achieved. The legal battle is likely to be protracted, potentially reaching the Supreme Court, offering more clarity on the intricate balance between state autonomy, central oversight, and judicial review in India.

Exam Tips

This topic falls under 'Indian Polity and Governance' (UPSC Mains GS-II, State PSCs) focusing on Federalism, Centre-State Financial Relations, and Constitutional Bodies. It also relates to 'Indian Economy' (UPSC Mains GS-III, Banking, SSC) covering Public Finance, External Sector, and Financial Markets.

Study the powers and functions of the Enforcement Directorate (ED) and its legal basis (FEMA, PMLA). Understand the concept of Masala Bonds, External Commercial Borrowings (ECBs), and the role of the Reserve Bank of India (RBI) in regulating foreign exchange and capital flows. Revise Article 293 of the Constitution related to state borrowing.

Common question patterns include MCQs asking about the legal basis of ED's action (FEMA), the nature of Masala Bonds, or constitutional articles related to state borrowing. Mains questions could focus on the challenges to fiscal federalism in India, the role of central agencies in state matters, or the pros and cons of innovative state financing mechanisms like masala bonds.

Related Topics to Study

Full Article

Stay order comes on joint petition filed by Pinarayi, former Finance Minister Thomas Isaac and KIIFB CEO K.M. Abraham challenging the show-cause notice