Relevant for Exams

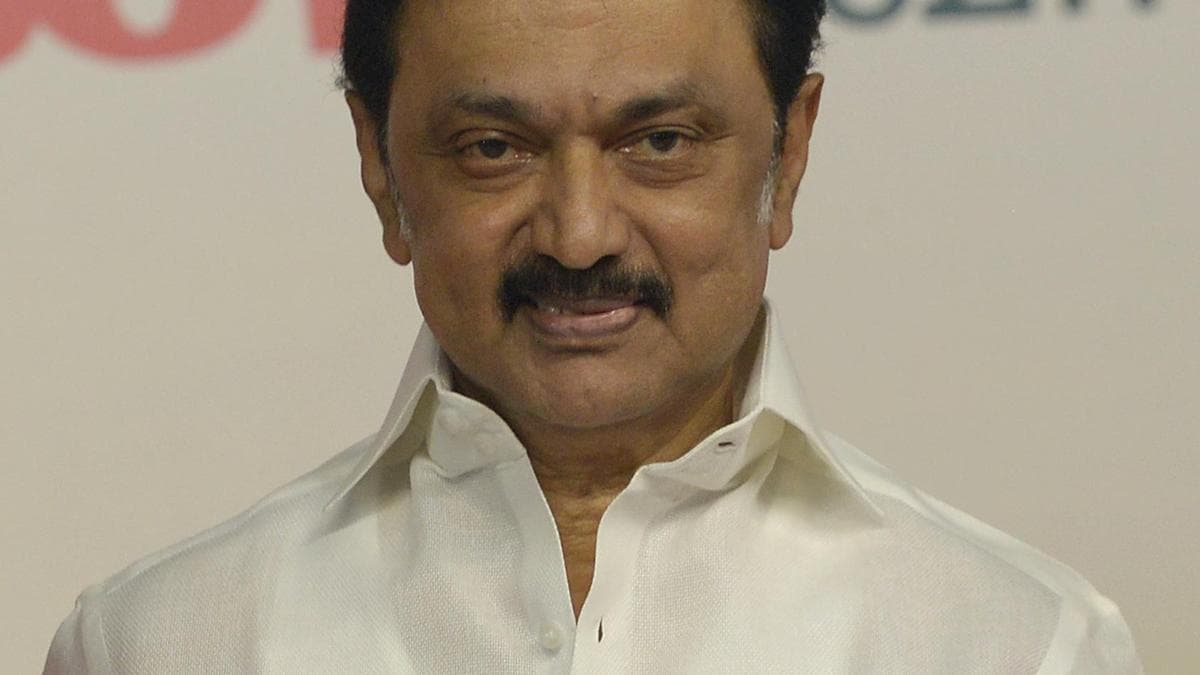

TN CM Stalin claims 16% GSDP growth and economic leadership under DMK government.

Summary

Tamil Nadu Chief Minister M.K. Stalin announced that the state has become a leader in economic growth under the DMK government, achieving a Gross State Domestic Product (GSDP) growth rate of 16%. He further noted a significant milestone in per capita income, attributing these successes to state policies despite alleged inadequate support from the Centre. This highlights state-level economic performance and inter-governmental fiscal relations, crucial for competitive exam understanding of India's economic landscape.

Key Points

- 1Tamil Nadu Chief Minister M.K. Stalin stated the state has emerged as a leader in economic growth.

- 2The economic progress was attributed to the policies implemented by the DMK government.

- 3Tamil Nadu reported a Gross State Domestic Product (GSDP) growth rate of 16%.

- 4The state also achieved a significant milestone in its per capita income.

- 5Stalin claimed these achievements were made despite inadequate support from the Central government.

In-Depth Analysis

Tamil Nadu Chief Minister M.K. Stalin's assertion that the state has emerged as a leader in economic growth, achieving a 16% Gross State Domestic Product (GSDP) growth rate and a significant milestone in per capita income despite alleged inadequate support from the Centre, encapsulates several critical facets of India's federal structure, economic development, and inter-governmental fiscal relations. This statement is not merely a political claim but opens a window into the dynamic interplay between state autonomy and central policies.

**Background Context and What Happened:**

India operates as a federal system where states play a crucial role in economic development, often implementing policies tailored to their specific needs and resources. Tamil Nadu has historically been one of India's more industrialized and urbanized states, known for its robust manufacturing sector (automobiles, textiles, electronics) and strong human development indicators. The Dravida Munnetra Kazhagam (DMK) government, under CM Stalin, came to power with a mandate focusing on social welfare and economic growth. The recent announcement highlights the state's claimed GSDP growth rate of 16% and improved per capita income, attributing these successes to the DMK government's policies. The crucial political dimension here is the accompanying claim that these achievements were made "despite not receiving adequate support from the Centre," a common refrain from state governments, particularly those governed by opposition parties.

**Key Stakeholders Involved:**

1. **Tamil Nadu Government (DMK):** The primary stakeholder, responsible for state-level policymaking, budget allocation, and implementation of development programs. Their claims of economic success are aimed at demonstrating effective governance and justifying their policy choices.

2. **Central Government:** The Union government is responsible for national economic policy, fiscal transfers to states (based on Finance Commission recommendations), and various Centrally Sponsored Schemes. The allegation of "inadequate support" directly implicates the Centre's role in fiscal federalism.

3. **Citizens and Businesses of Tamil Nadu:** The ultimate beneficiaries and drivers of economic growth. Their prosperity and economic activities contribute to GSDP and per capita income.

4. **Economists and Policy Analysts:** They scrutinize such claims, analyzing the data (e.g., nominal vs. real GSDP growth, methodology for per capita income calculation) and evaluating the effectiveness of state and central policies.

**Why This Matters for India:**

This development is significant for India on multiple fronts. Economically, it underscores the importance of sub-national growth engines. States like Tamil Nadu contribute significantly to India's overall GDP, and their individual economic performance can drive national growth. The GSDP growth rate, even if nominal, indicates substantial economic activity. Politically, the statement highlights the ongoing tensions in India's fiscal federalism. States often argue for greater fiscal autonomy and a larger share of central taxes and grants. The claim of achieving growth despite central non-support fuels this debate, potentially leading to increased demands for changes in the devolution formula or GST compensation mechanisms. Socially, sustained economic growth and higher per capita income can lead to improved living standards, better public services, and reduced poverty, contributing to inclusive development.

**Historical Context and Constitutional Provisions:**

India's Constitution establishes a robust framework for Centre-State financial relations, primarily outlined in **Part XII (Finance, Property, Contracts and Suits)**. Key articles include:

* **Article 270:** Deals with taxes levied and collected by the Union but distributed between the Union and the States.

* **Article 275:** Empowers Parliament to make grants-in-aid to certain States which are in need of assistance.

* **Article 280:** Mandates the President to constitute a Finance Commission every five years (or earlier) to make recommendations on the distribution of net proceeds of taxes between the Union and the States (vertical devolution) and the allocation of shares among the States (horizontal devolution), and the principles that should govern the grants-in-aid to the States.

The history of Centre-State financial relations has been marked by commissions like the Sarkaria Commission (1983) and the Punchhi Commission (2007), which have consistently recommended greater fiscal autonomy for states and a more equitable sharing of resources. The introduction of the Goods and Services Tax (GST) via the **101st Constitutional Amendment Act, 2016**, and the establishment of the **GST Council (Article 279A)**, further transformed indirect tax collection and distribution, creating new avenues for Centre-State dialogue and occasional friction over revenue shares and compensation for revenue losses.

**Future Implications:**

Such claims from a prominent state like Tamil Nadu could intensify the debate on fiscal federalism. Other states might cite Tamil Nadu's example to demand more financial resources and greater flexibility in spending. This could lead to:

* Renewed calls for reviewing the terms of reference for future Finance Commissions.

* Demands for extending GST compensation beyond the initial five-year period.

* Increased scrutiny of Centrally Sponsored Schemes and their alignment with state priorities.

* A push for greater autonomy in borrowing and managing state finances.

Moreover, the economic performance of states fosters competitive federalism, where states strive to attract investment and demonstrate better governance. This competition can be healthy for national development but also highlights regional disparities and political differences. The future will likely see state governments increasingly leveraging their economic performance as a bargaining chip in their interactions with the Centre, shaping policy debates and resource allocation for years to come.

Exam Tips

**UPSC GS Paper III (Economy) & GS Paper II (Polity):** Focus on the concepts of Fiscal Federalism, Centre-State financial relations, the role and recommendations of the Finance Commission (Article 280), and the Goods and Services Tax (GST) Council (Article 279A). Understand the difference between GDP and GSDP, and nominal vs. real growth rates. Questions often test your understanding of constitutional provisions related to finance and the impact of central policies on state economies.

**State PSC Exams:** This topic is highly relevant for state-specific exams. Be prepared for questions on your state's economic indicators (GSDP, per capita income, key industries), specific state government schemes, and the state's financial relations with the Centre. Comparative analysis of your state's performance with national averages or other states is also a common question pattern.

**Common Question Patterns:** Expect analytical questions on the challenges of fiscal federalism in India, the impact of GST on state revenues, the functions and recommendations of the latest Finance Commission, and the mechanisms for resource transfer from the Centre to states. Multiple-choice questions might test specific constitutional articles (e.g., Article 280 for Finance Commission) or key economic terms.

**Related Topics to Study Together:** When studying this, also cover the various types of grants (statutory, discretionary), the concept of 'horizontal' and 'vertical' devolution of taxes, the impact of COVID-19 on state finances, and the role of the NITI Aayog in cooperative federalism.

Related Topics to Study

Full Article

He says the State has reported GSDP growth rate of 16% despite not receiving adequate support from the Centre; it has also achieved a significant milestone in per capita income, the CM adds